The cash flow to stockholders calculator is an indispensable tool for investors and financial analysts, providing a comprehensive understanding of a company’s financial performance and its ability to generate and distribute cash to shareholders. This calculator empowers users to evaluate the health of a company, assess its cash flow management strategies, and make informed investment decisions.

By delving into the components of cash flow to stockholders, including dividends, stock repurchases, and other distributions, this calculator offers a granular view of how companies allocate their cash resources. It enables users to identify trends and patterns in cash flow, assess the impact of various factors on cash flow generation, and gain insights into a company’s long-term financial prospects.

Definition of Cash Flow to Stockholders

Cash flow to stockholders, often referred to as dividends, represents the portion of a company’s earnings that are distributed to its shareholders. It is a key indicator of a company’s financial health and its ability to generate cash from its operations.

Cash flow to stockholders can benefit shareholders in several ways. First, it provides a return on their investment, rewarding them for their ownership stake in the company. Second, it can be used to reinvest in the company, helping it grow and expand its operations.

Third, it can provide shareholders with a source of income, particularly for those who rely on dividends as part of their retirement planning.

Importance of Cash Flow in Evaluating a Company’s Financial Health

Cash flow is a critical factor in evaluating a company’s financial health. A company with strong cash flow is better able to meet its financial obligations, invest in growth, and weather economic downturns. Conversely, a company with weak cash flow may face difficulty paying its bills, investing in its business, and meeting its debt obligations.

Components of Cash Flow to Stockholders

Cash flow to stockholders (CFS) represents the amount of cash a company distributes to its shareholders. It encompasses various components, each contributing to the overall flow of funds to investors.

The primary components of CFS include dividends, stock repurchases, and other distributions. Dividends are periodic payments made to shareholders, representing a portion of the company’s earnings. Stock repurchases involve the company buying back its own shares, reducing the number of outstanding shares and potentially increasing the value of the remaining shares.

Other distributions may include special dividends, stock splits, and rights offerings.

Dividends

Dividends are the most common form of CFS. They are typically paid in cash or stock and represent a direct distribution of earnings to shareholders. Companies may declare dividends on a regular basis (e.g., quarterly or annually) or as special payments.

Stock Repurchases

Stock repurchases are another important component of CFS. When a company repurchases its shares, it reduces the number of shares outstanding. This can lead to an increase in earnings per share and potentially boost the stock price.

Other Distributions, Cash flow to stockholders calculator

Other distributions to stockholders may include special dividends, stock splits, and rights offerings. Special dividends are one-time payments made in addition to regular dividends. Stock splits increase the number of shares outstanding without affecting the total market capitalization. Rights offerings give shareholders the opportunity to purchase additional shares at a discounted price.

Companies implement these strategies for various reasons. Dividends provide a regular income stream for investors and can attract long-term shareholders. Stock repurchases can enhance shareholder value and improve financial ratios. Other distributions can be used to reward shareholders or raise additional capital.

Methods for Calculating Cash Flow to Stockholders

Cash flow to stockholders (CFS) represents the cash generated by a company that is available for distribution to its shareholders. There are two primary methods used to calculate CFS: the indirect method and the direct method.

Indirect Method

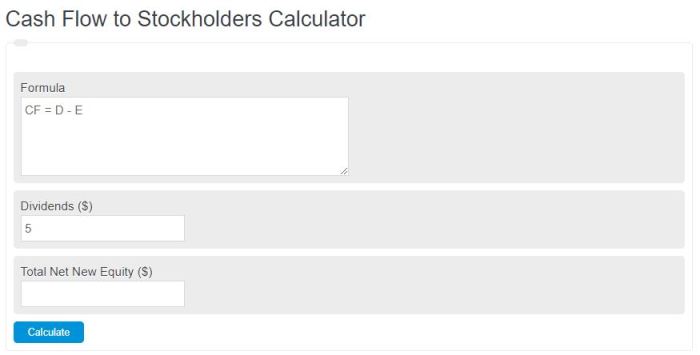

The indirect method starts with net income and adjusts it for non-cash items and changes in working capital to arrive at CFS. The formula is as follows:

- CFS = Net income + Depreciation and amortization – Increase in working capital

Advantages of the indirect method include its simplicity and the fact that it is widely used. However, it can be less transparent than the direct method.

Direct Method

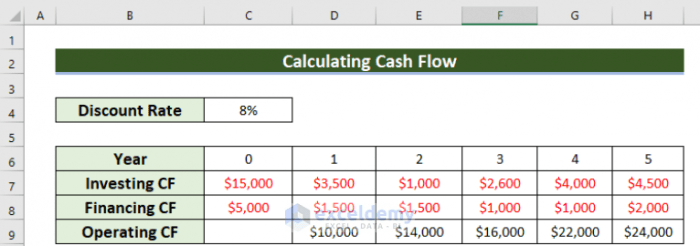

The direct method calculates CFS by summing up the cash inflows and outflows from operating, investing, and financing activities. The formula is as follows:

- CFS = Operating cash flow + Investing cash flow + Financing cash flow

Advantages of the direct method include its transparency and the fact that it provides more detailed information about the sources and uses of cash. However, it can be more complex to calculate than the indirect method.

Factors Affecting Cash Flow to Stockholders

Cash flow to stockholders is influenced by a combination of internal and external factors. Understanding these factors is crucial for companies seeking to enhance shareholder value.

Key factors affecting cash flow to stockholders include profitability, capital structure, and industry trends.

Profitability

- Higher profitability, measured by metrics such as net income and operating cash flow, generally leads to increased cash flow available for distribution to stockholders.

- Companies with strong profit margins can generate more cash to pay dividends or repurchase shares.

Capital Structure

- Capital structure refers to the mix of debt and equity financing used by a company.

- Companies with higher debt levels may have less cash available for stockholders due to interest payments and debt repayment obligations.

Industry Trends

- Industry trends can significantly impact cash flow to stockholders.

- Companies operating in cyclical industries may experience fluctuations in cash flow due to economic downturns.

- Companies in growth industries may have higher cash flow due to increased demand for their products or services.

Example:

Apple Inc., a highly profitable company with a strong capital structure, has consistently generated significant cash flow to stockholders through dividends and share repurchases.

Impact of Cash Flow to Stockholders on Stock Price

Cash flow to stockholders (CFS) plays a crucial role in determining the value and performance of a company’s stock. Investors and analysts closely monitor CFS as it provides insights into a company’s financial health, profitability, and ability to generate returns for shareholders.

Empirical evidence consistently demonstrates a positive correlation between CFS and stock price. Companies with strong and consistent CFS tend to have higher stock prices than those with weak or negative CFS. This relationship is attributed to the fact that CFS represents the cash available to shareholders after meeting all expenses and obligations, indicating the company’s capacity to pay dividends and repurchase shares.

Investors’ Use of CFS Data

Investors use CFS data to make informed investment decisions and assess a company’s long-term prospects. Here are some ways investors utilize CFS information:

- Dividend Potential:CFS is a key indicator of a company’s ability to pay dividends to shareholders. Companies with high CFS are more likely to maintain or increase dividend payments, making them attractive to income-oriented investors.

- Stock Repurchases:CFS can also indicate a company’s potential for stock repurchases. Companies with excess CFS may use it to repurchase their own shares, which can boost earnings per share and increase stock value.

- Growth Prospects:CFS can provide insights into a company’s ability to invest in growth initiatives. Companies with strong CFS are better positioned to expand their operations, develop new products, and acquire other businesses, leading to potential stock price appreciation.

- Financial Stability:CFS reflects a company’s financial stability and ability to withstand economic downturns. Companies with consistent CFS are less likely to face financial distress or bankruptcy, which can protect shareholder value.

Case Studies: Cash Flow To Stockholders Calculator

Companies with strong cash flow to stockholders have consistently demonstrated their ability to generate and distribute cash to shareholders, enhancing their overall financial performance and shareholder returns.

These companies often implement strategies that prioritize shareholder value, such as dividend payments, share buybacks, and special dividends.

Apple Inc.

Apple Inc. has a long history of strong cash flow to stockholders, with consistent dividend payments and share buyback programs. The company’s strong brand loyalty, innovative products, and efficient supply chain management have enabled it to generate significant cash flow, which it has used to reward shareholders.

In 2022, Apple paid out $14.9 billion in dividends and repurchased $90 billion worth of its shares, demonstrating its commitment to returning cash to shareholders.

Microsoft Corp.

Microsoft Corp. is another company with a strong track record of cash flow to stockholders. The company has paid dividends for over 20 consecutive years and has consistently increased its dividend payout. Microsoft has also implemented a share buyback program, reducing the number of outstanding shares and increasing the value of existing shares.

In 2022, Microsoft paid out $19 billion in dividends and repurchased $60 billion worth of its shares, highlighting its focus on shareholder returns.

ExxonMobil Corp.

ExxonMobil Corp. is an oil and gas company that has benefited from rising energy prices in recent years. The company has used its strong cash flow to increase its dividend payments and implement a share buyback program.

In 2022, ExxonMobil paid out $15 billion in dividends and repurchased $10 billion worth of its shares, demonstrating its commitment to returning cash to shareholders.

Limitations of Cash Flow to Stockholders

Cash flow to stockholders (CFS) is a valuable financial metric that provides insights into a company’s ability to generate cash and distribute it to shareholders. However, it is essential to acknowledge the limitations of using CFS as a sole indicator of a company’s financial health.Potential

biases and distortions can arise when interpreting CFS data. One limitation is that CFS can be influenced by accounting practices and timing differences. For example, a company may engage in transactions that temporarily increase CFS but do not reflect underlying economic performance.

Additionally, CFS can be affected by non-cash items, such as depreciation and amortization, which can distort the actual cash flow available to shareholders.To mitigate these limitations, it is advisable to use CFS in conjunction with other financial metrics for a more comprehensive analysis.

Key ratios such as dividend payout ratio and dividend yield can provide additional insights into a company’s dividend policy and the sustainability of its cash flows. Moreover, evaluating CFS over multiple periods can help identify trends and mitigate the impact of short-term fluctuations.

Conclusion

Cash flow to stockholders (CFS) serves as a crucial indicator of a company’s financial health and shareholder value. It gauges the company’s ability to generate cash for its investors and is a more comprehensive measure of financial performance than earnings per share or other profitability metrics.

Investors and financial analysts should prioritize cash flow data in their decision-making processes. By analyzing CFS, they can assess a company’s ability to pay dividends, fund growth initiatives, and repay debt. CFS also provides insights into the sustainability of a company’s earnings and its overall financial position.

Recommendations for Investors and Financial Analysts

- Utilize CFS to evaluate a company’s ability to distribute dividends and the likelihood of dividend growth.

- Assess the company’s financial flexibility by examining its CFS in relation to capital expenditures and debt obligations.

- Compare CFS with earnings per share and other profitability metrics to gain a comprehensive view of the company’s financial performance.

- Monitor changes in CFS over time to identify trends and potential red flags.

- Consider CFS in conjunction with other financial metrics, such as return on equity and debt-to-equity ratio, for a holistic analysis of the company’s financial health.

FAQ

What is cash flow to stockholders?

Cash flow to stockholders refers to the cash generated by a company that is distributed to its shareholders in the form of dividends, stock repurchases, or other distributions.

How is cash flow to stockholders calculated?

Cash flow to stockholders can be calculated using the indirect method or the direct method. The indirect method starts with net income and adjusts it for non-cash items and changes in working capital, while the direct method directly reports cash inflows and outflows from operating, investing, and financing activities.

What are the factors that affect cash flow to stockholders?

Factors that affect cash flow to stockholders include profitability, capital structure, industry trends, and management decisions regarding cash allocation.